In recent years, digital wallets have become increasingly popular in India. A digital wallet is a virtual wallet that allows you to store payment information and make transactions from your mobile device, eliminating the need for physical currency or plastic cards. As digital payment technology continues to grow, there are a multitude of digital wallet apps available in India, each with its own set of features.

A digital wallet, also known as an e-wallet or mobile wallet, is an electronic device or software application that securely stores credit or debit card information, as well as other types of payment information, such as bank account details. Digital wallets allow users to complete transactions by using their mobile devices, eliminating the need for cash or physical cards.

The digital wallet works by linking multiple payment options to a single, centralized account. Once a user adds their payment information to the wallet, the information is securely stored and can be accessed for future payments. The payment details can be added manually or automatically, and the wallet software can be set up to automatically update with the latest payment information each time a transaction is completed.

Digital wallets work by linking multiple payment options to a single, centralized account. Once payment information is added to the wallet software, it can be accessed for future transactions. The payment information can either be added manually, or the application can be set up to automatically update the wallet each time a transaction is completed.

Here is how a digital wallet is used:

1. Setting up a Digital Wallet: Customers can download a digital wallet application from the app store and create an account. The process for creating an account usually requires basic information such as the user’s name, email address or mobile number, date of birth, and bank account details.

2. Adding Payment Information: After registration, customers can add their credit or debit card information, net banking details, or other payment information that needs to be stored and accessed for future transactions. Customers can also set up automatic payments or recurring payments for bills, insurance premiums, subscriptions or memberships.

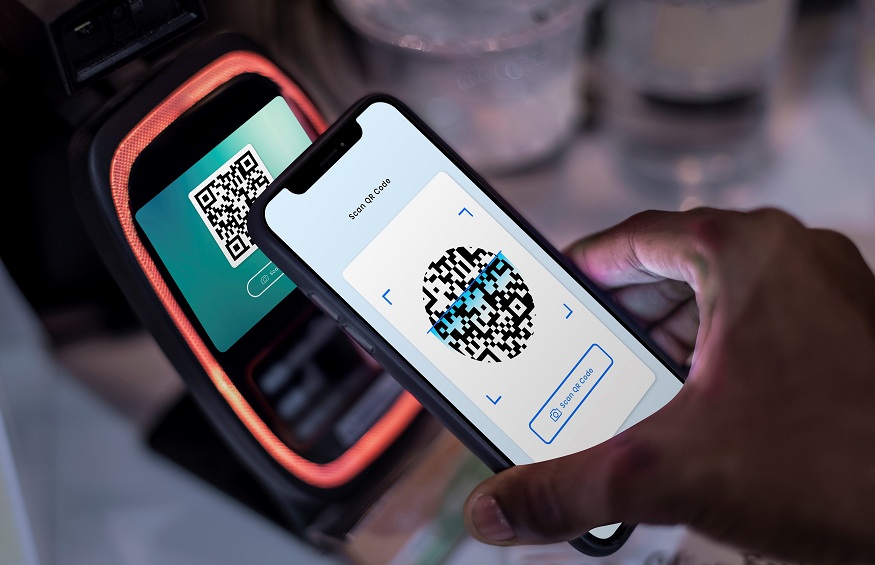

3. Completing Transactions: Once the payment information is added, customers can select the digital wallet as their payment option while making a purchase on the merchant site or application. The digital wallet application will then prompt the customer to confirm the payment details, and the transaction is completed after authentication.

4. Verification: When payments are made via a digital wallet, the transaction is secure, with multiple levels of security checks, such as a password, two-factor authentication, or biometric identification, depending on the security measures put in place by the digital wallet provider. This ensures secure transactions and provides customers with peace of mind.

The Features of Digital Wallet Apps in India

Digital wallet apps offer a variety of features that make your transactions quick and easy. Here are some of the most common features that are available in most digital wallets:

- Easy sign-up: Signing up for a digital wallet is a quick and easy process. You usually only need a mobile number and an email address to get started.

- User-friendly interface: Digital wallet apps are designed to be user-friendly, with easy navigation and access to different features.

- Multiple transaction options: Digital wallets support a variety of transactions, including sending and receiving money, paying bills, recharging your mobile and DTH connections, and purchasing goods and services online.

- Security: The security of digital transactions is paramount, and digital wallets use encryption and multi-level authentication to ensure secure transactions. Many apps use biometric authentication, such as fingerprint or facial recognition, for added security.

- Loyalty programs: Many digital wallet apps offer cashback, discounts, and loyalty rewards for using the app and completing transactions.

The Benefits of Using Digital Wallet Apps

Using digital wallets has many benefits, for both customers and merchants. Here are some of the most significant advantages of using digital wallets:

- Convenience: Digital wallets make transactions quick and easy, eliminating the need for physical currency or cards.

- Security: Digital wallet apps use advanced encryption and authentication methods to ensure secure transactions.

- Cost-effective: Digital payments are usually free or have minimal transaction fees, making them a cost-effective option for small transactions.

- Easy to track: Digital transactions are easily trackable, allowing users to keep a record of their spending.

- No need for cash: Digital wallets eliminate the need for carrying cash, making it a safe and hassle-free option.

- Loyalty benefits: Many digital wallet apps offer cashback, discounts, and loyalty rewards for transactions, providing added benefits for users.

The Risks Associated With Digital Wallet Apps

While digital wallets offer many benefits, there are certain risks associated with their use. Some of the significant risks include:

1. Security breaches: Digital wallets are susceptible to hacking and security breaches, resulting in fraudulent transactions.

2. Loss or theft of the mobile phone: If a mobile phone containing a digital wallet is lost or stolen, it could result in unauthorized access to the digital wallet and transactions.

3. Technical glitches: Technical glitches or system failures could result in erroneous transactions or loss of data.

4. Limited acceptance: While digital wallets are gaining popularity, not all merchants accept digital payments.

Digital Wallet Apps Available in India

Here is a brief overview of some of the popular options:

- The Bajaj Finserv app is one of the most comprehensive digital wallet solutions available in India. The app offers a wide range of features and benefits, making it an ideal choice for your financial needs. The app supports a wide range of transactions, including sending and receiving money, paying bills, recharging mobile connections and DTH, and purchasing goods and services. The app offers cashback, discounts, and loyalty rewards for using the app and completing transactions.

- PhonePe: PhonePe is a popular digital wallet app that allows you to send and receive money, pay bills, and recharge your mobile and DTH connections. The app uses UPI for secure transactions.

- Paytm: Paytm is one of the most popular digital wallet apps in India, offering a range of services, including sending and receiving money, paying bills, and booking tickets.

- Google Pay: Google Pay is a secure digital wallet app that allows you to send and receive money, pay bills, and recharge your mobile and DTH connections.

- Mobikwik: Mobikwik is a digital wallet app that offers services such as sending and receiving money, paying bills, and recharging your mobile and DTH connections. The app also offers various cashback and discount offers.

- Amazon Pay: Amazon Pay is a digital wallet app that allows you to pay bills, buy goods and services, and recharge your mobile and DTH connections. The app provides secure transactions and various cashback offers.

Conclusion

Digital wallets have become an essential part of our lives, making transactions quick and convenient. While digital wallet apps offer numerous benefits, it is crucial to ensure the security and reliability of the app before using it. The Bajaj Finserv app is a comprehensive digital wallet solution that provides a wide range of features and benefits. However, there are other excellent digital wallet apps available in India, such as PhonePe, Paytm, Google Pay, Mobikwik, and Amazon Pay.